Indices too rise on expectation of intervention by authorities; forex reserves slip below $400 billion

Expectations around intervention by the authorities to steady the rupee, with Prime Minister Narendra Modi set to meet policymakers this weekend to review the economic situation, helped the rupee appreciate against the dollar further on Friday.

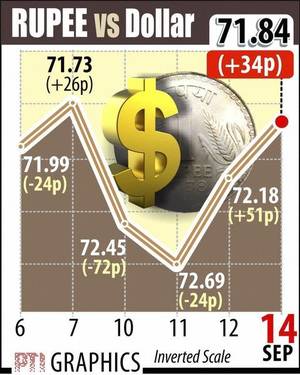

Opening at 71.70 to a dollar compared to its previous close of 72.18, the rupee touched the day’s high at 71.53 before ending at 71.84, appreciating about 0.47% against the dollar. Importers’ demand for the dollar weighed on the Indian currency towards the closing hour of trade.

U.S.-China trade talks

The Indian benchmark indices too responded favourably, rising for the second consecutive trading session on Friday. Reports that the U.S. and China are mulling new round of trade talks also acted as a catalyst.

“We are also closely monitoring the developments impacting the INR, including the government’s planned review of the economy with PM Modi this weekend,” Nomura said in a report to its clients. “Our [forex] strategy team believes that risk of Indian authorities announcing measures to stabilise INR is rising, but they remain bearish on INR as they expect weakness to be driven by global factors,” it said.

According to latest data, RBI sold only $1.8 billion in the spot currency market in July, compared to $6.2 billion in June. The country’s foreign exchange reserves dropped to $399.3 billion for the week ended September 7, according to RBI data. Foreign exchange reserves have fallen $26 billion from its record high of $426 billion, as at April 13, 2018.

28 in Sensex pack gain

The 30-share Sensex gained 372.68 points, or 0.99%, to close at 38,090.64 with 28 of its constituents ending with gains. NTPC, Asian Paints, Power Grid Corporation and Vedanta were among the top gainers, moving up in excess of 3% each.

The Sensex last closed above the psychological 38,000-mark on September 7. In the last two sessions, the index has gained 677 points after having cumulatively lost nearly 1,000 points on Monday and Tuesday. The Nifty of the National Stock Exchange closed at 11,515.20, up 145.30 points.

Jimeet Modi, CEO, Samco Securities, said that while the markets have gained ground for two consecutive sessions, it cannot be looked upon as a beginning of a new rally because corrections rarely happen for such a short period.

“Given that Fed meeting and global headwinds are key uncertainties, investors should not take this as a buying opportunity but should consider booking profits. Crude oil fear is overdone and given the rupee’s rally, we think crude will no longer be a risk to the market in the medium term,” he said.