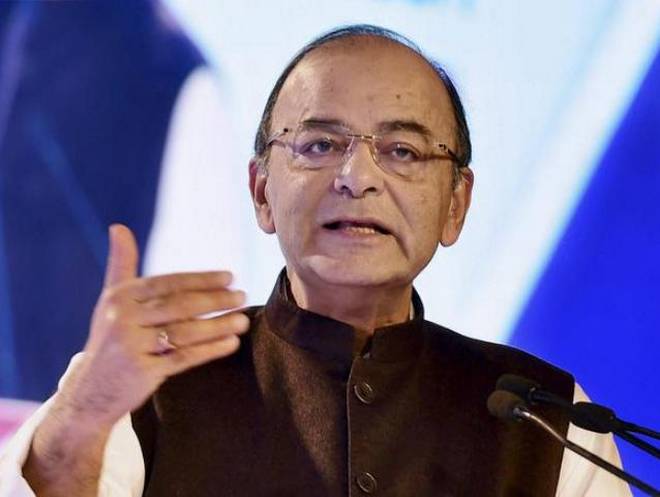

Finance minister Arun Jaitley in his fifth and last full-fledged budget presentation before the 2019 Lok Sabha polls will be under pressure from India Inc. to fulfil his promise of reducing corporate taxes to boost job creation and drive investments.

Mr. Jaitley, who had promised to ultimately reduce the corporate tax rate to 25%, is yet to deliver.

“Topping the budget wish list of India Inc., is the request to reduce corporate tax by at least 5%,” said Shilip Kumar, President, Henkel India. “Cutting down the corporate tax rates drastically will enable the government to create an environment which will facilitate smooth functioning and growth of businesses. In all probability such a move will help boost job creation and drive investments to the country.”

Staying competitive

EY expects this year may see a reduction in the overall corporate tax rate in line with the suggested roadmap, to maintain India’s competitiveness in the global arena, more specifically in light of the recently announced reduction in U.S. corporate tax rates.

“With large economies like Japan and U.S.A. resorting to tax cuts, corporate India would be pressing for tax cuts,” said Abhijeet Biswas, MD & co-founder, 7i Advisors LLP.

Echoing similar feelings, Hemant Kanoria, CMD Srei Infrastructure Finance Ltd. said, “The finance minister, during an earlier budget presentation, had announced a roadmap for cutting basic rate of corporate tax to 25%. Although this was done for SMEs, an implementation across the board would encourage private investment and boost employment.”

In 2017 budget, corporate tax rate of 25% was levied for enterprises with less than ₹50 crore turnover.

Phased elimination

“It is expected to extend the benefit of lower tax rate from the existing 30% with a phased elimination of exemptions,” said Pranay Bhatia, Partner – Tax & Regulatory Services, BDO India. “Phasing out of exemptions may result in gradual alignment of book profits with the taxable profits, thereby expecting a cut in the MAT rate, eventually phasing out MAT provisions.”

“Rejigging the personal income-tax exemption limit together with cut in the corporate tax rate is merited in the light of broadening the tax base on introduction of GST, promoting ‘Make in India’, thereby making India more competitive in terms of doing business and given the big ticket U.S. tax reforms,” Mr. Bhatia added.